Minimum wage paycheck calculator

1000 per paycheck or the first 75 of disposable earnings whichever is greater is exempt from wage garnishment. 24 new employer rate Special payroll tax offset.

Life Skills Bingo Worksheet Free Consumer Math Consumer Math Activities Teaching Life Skills

Paycheckin constantly researches and updates the minimum wage rate.

. Spent is an interactive game created by McKinney that challenges you to manage your money raise a child and make it through the month getting paid minimum wage after a stretch of unemployment. For more information about the Wage Theft Protection Act please review 195 of the New York Labor Code. The current federal minimum wage is 725 per hour and has not been raised in over 10 years.

Exempt means the employee does not receive overtime pay. The Tax Withholding Estimator doesnt ask for personal information such as your name social security number address or bank. The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay.

Use this paycheck calculator to figure out your take-home pay as an hourly employee in North Carolina. Minimum Wage in North Carolina in 2021. The maximum amount that can be garnished from your.

For more information about wage payment timing generally in New York please click here. Using a standard inflation calculator available through any web search the spending power of 725 in July 2009 offers the same buying power as 847 as of May. WAGE CLAIMS 2022 Studies show that as many as 4 out of 5 employees are the victims of wage theftIf your employer owes you money you have the right to immediately file a complaint with the California Labor Commissioners Office also referred to as the Division of Labor Standards Enforcement.

It can let you adjust your tax withheld up front so you receive a bigger paycheck and smaller refund at tax time. You may also want to convert an hourly wage to a salary. Minimum Wage in Florida.

Texas current minimum wage for tipped employees is 213 per hour. If you find an error please let Paycheckin know by filling out the contact form. Then enter the employees gross salary amount.

This means that a total of 124 is paid for each employee. The federal minimum wage for covered nonexempt employees is 725 per hour. Because were all only a paycheck or three away from needing to.

However some information in the tables may not be accurate. However some information in the tables may not be accurate. 09 Taxable maximum rate.

Use the Wage Garnishment Calculator to calculate the amount to be withheld from the employees pay for each pay period. Urban Ministries of Durham serves over 6000 people every year who struggle with poverty and homelessness. Click here to view a chart outlining the final paycheck timing requirements for each state.

The law defines a tipped employee as one that consistently receives tips of 20 or more a month while employed in an occupation according. About the Minimum Wages Database. 54 Taxable base tax rate.

725 is 28250 500 30 725 28250. Applies to all employees who are 16 or 17 and have worked for their current employer. That means the lowest salary a man thinks is acceptable at a new job is about 37 higher than the lowest wage a woman does.

By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. Convert my salary to an equivalent hourly wage. Applies to all employees over the age of 16 who arent training or starting out or who are involved in supervisory or training roles such as overseeing or instructing coworkers.

Employers must provide an employee with 24 hours written notice before a wage change. Many states also have minimum wage laws. The reservation wage for men rose to 86259 in July a record high from 83306 in March.

Employers are required. Minimum Wage Regulations. Also you may want to see if you have one of the 50 best jobs in America.

Texas has adopted by statute the federal minimum tipped wage rate set forth in the Fair Labor Standards Act TX Labor Code 62052. At the time of this writing 2017 Federal Law mandates that 62 of an employees taxable wage must be withheld and paid to the government. To try it out enter the employees name and location into our free online payroll calculator and select the salary pay type option.

This includes alternative minimum tax long-term capital gains or qualified dividends. Use this calculator to determine what your hourly wage equates to when given your annual salary - it may surprise you what you make on an hourly basis. Why Gusto Payroll and more.

This exemption applies to every paycheck regardless of how often the. By raising the minimum wage it does force employers to offer a larger paycheck to their workers. The amount by which disposable earnings exceed 30 times the federal minimum hourly wage currently 725 an hour or.

Basic minimum wage as of Jan 1 2015. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida. If you find an error please let Paycheckin know by filling out the contact form.

Target will pay a 24-an-hour minimum wage in tightest labor markets. Living wage refers to a theoretical wage level that allows an individual to afford adequate shelter food and the other necessities. It also reduces their internal costs because there are fewer instances of turnover.

To this the employer is required to match the amount withheld from the employees taxable wage and pay to the government as well. The tool helps individuals communities and employers determine a local wage rate that allows residents to meet minimum standards of living. We developed a living wage calculator to estimate the cost of living in your community or region based on typical expenses.

In cases where an employee is subject to both the state and federal minimum wage laws the employee is entitled to the higher of the two minimum wages. Call 213 992-3299 anytime. Paycheckin constantly researches and updates the minimum wage rate.

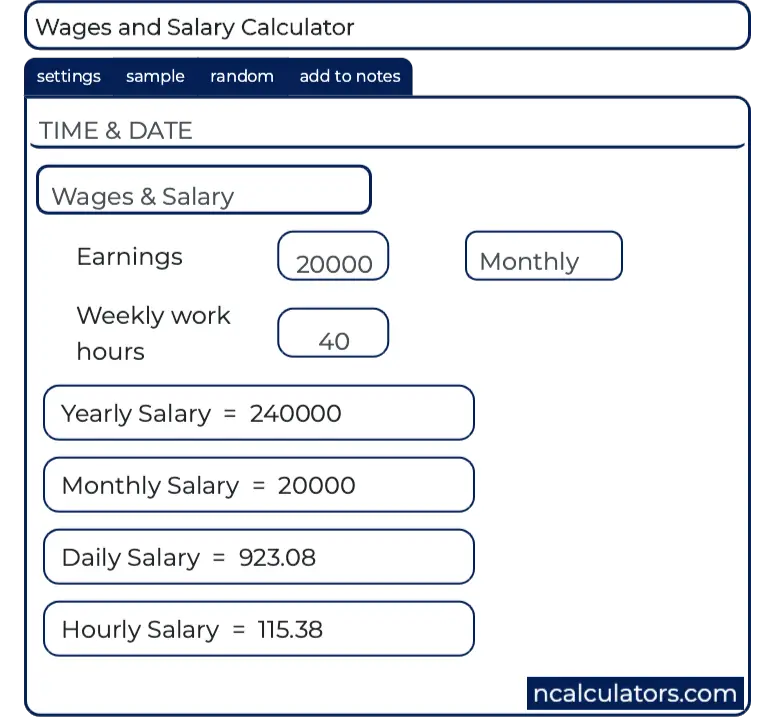

About the Minimum Wages Database. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. A full-time federal minimum wage worker today earns 18 less than what her counterpart earned at the time of the last increase after adjusting for rising costs of living 15080 annually in 2021 versus 18458 in 2009.

A living wage should be substantial enough to ensure that no. New York City Freelance Workers. Meanwhile the reservation wage for women declined to 59543 from 61676 in that same period.

Wage Calculator Sale Online 51 Off Www Wtashows Com

Wage Calculator Sale Online 51 Off Www Wtashows Com

When Gas Was A Quarter Teacher Lessons Gas Quarter

How To Create A Free Payslip Template In Excel Pdf Word Format How To Wiki Payroll Template Receipt Template Templates

How To Stretch A Paycheck In A One Income Family One Income Family Family Money Managing Your Money

Debt Collectors Must Follow Certain Laws And Regulations When Pursuing Your Debt This Includes Things Like Notifying The Con In 2022 Debt Collector Debt The Collector

Salary Minimum Wage And Payslips In The Netherlands

Salary To Hourly Free Online Paycheck Calculator

Net Pay Calculator On Sale 54 Off Www Wtashows Com

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Kepler S Tally Of Planets Planets Visual Distant

Paycheck Calculator Salaried Employees Primepay

Fzuy Orsy35hem

How To Calculate Your Net Salary In The Netherlands Undutchables

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

A Life You Love On A Budget You Can Afford The Budget Mom Shop For All Your Needs Bill Tracker Printable Budget Mom Paycheck Budget Printables

How To Choose From Free Pay Stub Templates Templates Marital Status Paying